Adam’s Take: Access Fee Cap

A review of US Exchange transaction fees is a long time coming, and I can almost feel the blue draining from my face. Even the most ardent supporter of the existing maker-taker model (and its inverse) should support a review of the access fee cap. The current access fee cap—$.003 per share— has not changed since originally proposed back in 2005. I’ve lost as much hair since then as equity market structure has gained. It’s time for a review.

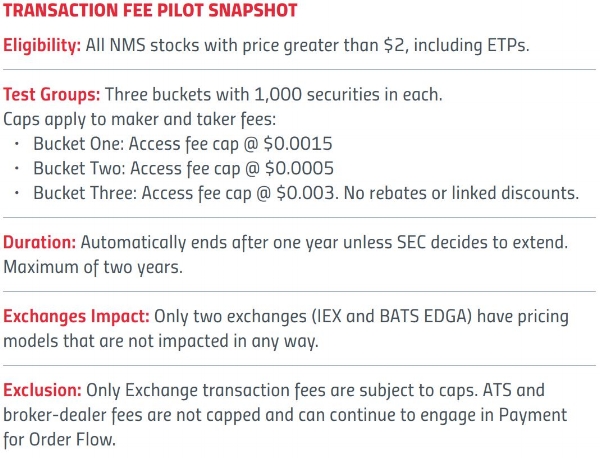

The SEC’s Transaction Fee Pilot is fairly straightforward in its design. While this comes at the expense of testing additional hypotheses within all or some of the buckets, the simplicity of the proposal allows the SEC to focus on one thing: how much does transaction fees drive behavior. Below is a quick overview.

The primary question the Transaction Fee Pilot is trying to answer is simple: how do Exchange transaction fees influence “order routing behavior, execution quality and market quality”? It’s obvious that economics will always play some role in order routing. Let’s say there’s a low-cost routing service called Routly. One of your second tier brokers uses Routly to access the markets. One of your orders needs to execute 100 shares in the lit market and more than one Exchange is at the inside. With all things being equal, Routly would route to the less expensive venue. Makes sense, right? Instead, Routly decides to try and get that 100 shares filled at one of the 30+ dark pools, all of which are cheaper than either of the Exchanges. By the time all 30 dark pools have been pinged (with no execution), the shares at the Exchange are no longer available and the quote moves against your order. Sad!

On one hand, differentiated pricing creates some level of conflict. On the other hand, there is concern that the maker-taker model exacerbates the conflict of interest. Even though sophisticated institutions can measure broker routing efficiency, widespread sub-optimal order routing could diminish overall market quality.

Our hope is that the data from the Pilot gives us a better understanding of the interplay of competition among Exchanges, payment for order flow arrangements and ATSs. Even though the Pilot only focuses on Exchange transaction fees, we will still get to see if order routing behavior changes to preserve existing economics across the three buckets.

For example, if we see an increase in off-Exchange market share among Bucket Three stocks, and the bulk of that shift is to wholesalers, it’s a safe bet that there is an economic incentive driving that change. If we see an increase in on-Exchange market share among Bucket Two stocks, one could surmise that lowering the cap to $0.0005 makes executing on Exchange a better value proposition than executing at most of the 30+ dark pools. (Present company excluded, of course)

Currently, there is a substantial difference between the maximum and minimum costs to take liquidity and provide liquidity across the Exchanges. As of April 2018, there is about a half-cent spread between the max and min on both sides (see bottom of chart below). This represents a substantial percentage of an institutional algorithmic commission rate of $.0065 per share (according to TABB Group’s report, “US Institutional Equity Trading 2017: In the Eye of the Storm”). It is hard to ignore that routing based on economics could make the difference as to whether a router is profitable or not.

How much will the various Access Fee Pilots reduce the economical conflict of interest? Let’s look at the net fees (rebate minus fee) for each Exchange and whether that net fee is possible under the various buckets. Let’s assume that the minimum net fee is zero.

As shown above, Bucket 2, an access fee cap of 5mils, forces four exchanges to rethink their pricing model. While Bucket 3 will eliminate the maker/taker model, eight Exchanges could maintain their current net fee. My belief is that the best way to minimize conflicts of interest is to lower the cap, not necessarily ban rebates. Of course, the point of the pilot is to test all of this, which is why it makes sense to include a zero-rebate bucket. The inability to pay a rebate should reduce overall Exchange fees.

However, as the SEC acknowledges, the three buckets do not operate in isolation. The interplay of rebates and fees could be spread across all three buckets.

Per the SEC:

“Alternatively, exchanges may revise pricing strategies for stocks in other groups, choosing to implicitly subsidize rebates for stocks in some test groups using fees from stocks in other test groups. This may increase competition for order flow in some test groups while reducing it in others.”

In other words, the conflict of interest in Bucket Two could merely be shifted to another group of securities. And yet, I believe the SEC would rightly argue that the shift would be informative. It’s important to remember that the purpose of the Pilot isn’t to see if any of the three Buckets are more effective than the current rule but rather how changes impact behavior.

The question is not whether 30mils is still the right number. We know it’s not. A protected quote is not worth 30mils.

The Pilot proposal is a clear recognition that the access fee cap’s impact on market structure has evolved since it was created in 2005. During the Reg NMS proposal process, there was general support for an access fee cap; the debate was around the details. The primary rationale for the access fee cap was to prevent market centers from abusing the protected quote status to extract high fees. The SEC based 30mils on common pricing—only two venues were charging more.

Nowadays, the objective isn’t preventing market centers from abusing the protected quote status. The concerns are more around maker-taker spreads and the associated role of rebates in that spread. The primary belief behind lowering access fee caps is to reduce the conflicts of interest in order routing.

However, maybe the SEC isn’t going far enough in its Pilot. The US is one of the few markets whose Exchanges charge a flat fee per share instead of notional. Changing the fee structure from per-share to notional aligns trading venue costs with most every other trading cost measurement. Shouldn’t venues be compensated based on the amount of risk transfer they facilitate? It’s kind of like how we still use the English measurement system while the rest of the world uses metric. Sad!

And while we’re at it, why not change tick sizes to basis points as well? Globally harmonized ticks. Uh oh. I feel my face turning blue again.